On April 26, 2020, the Federal Trade Commission (FTC) reported that it has received over 27,000 complaints related to COVID-19 consumer scams since the pandemic began this year. The elderly and minority populations are the most vulnerable to these new scammers, so we need to be on top of new developments of scammers and think of ways to reduce the likelihood of being a victim.

These COVID-19 consumer scam complaints have mainly been about fraud in travel and vacation services, online shopping, and mobile texts. For travel and vacation services, complaints have been regarding refunds or vouchers, which many consumers are waiting to get due to cancellation of flights, hotels, car rentals, and other travel services.

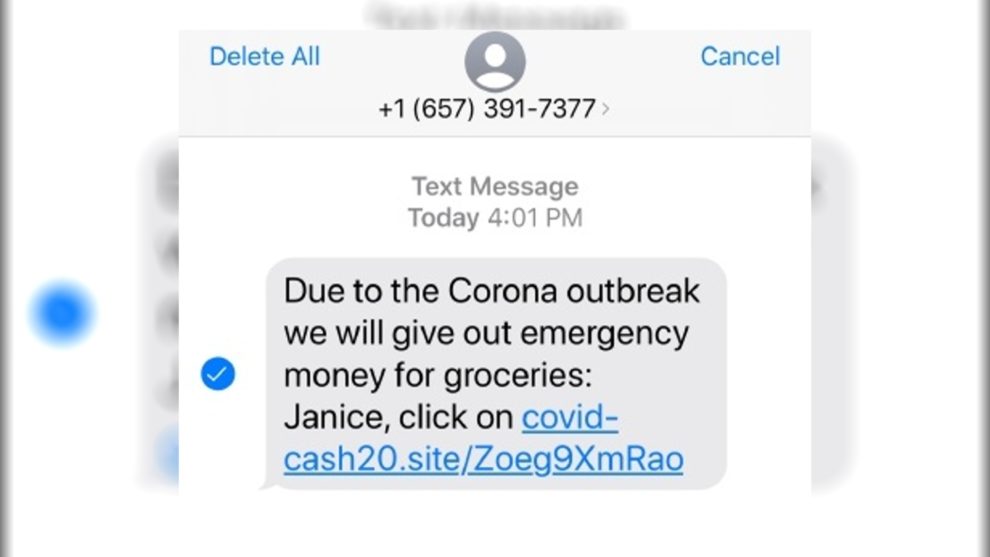

But there also have been numerous new complaints filed about how scammers are posing as government agencies or even posing as well-known legitimate businesses with the intent of contacting individuals and small-businesses asking for personal information, especially social security and credit card numbers, or charging small fees for processing stimulus checks. Text messaging is now the new form of contact for these scams.

But text messaging is just one of the different ways that scammers are trying to get personal information from consumers or businesses. Other ways for scamming people are taking place in person at parking lots in front of grocery stores, by knocking on homes, through phone calls, and via email messages.

Or, scammers are also using fake email accounts posing as the Centers for Disease Control and Prevention (CDC), or as the U.S. Department of Health and Human Services (HHS), or even as the World Health Organization (WHO) asking for social security numbers and other personal information in exchange for COVID-19 test kits.

The elderly population has been especially the target for this new type of scam. According to the latest facts, there are no approved COVID-19 test kits available in the U.S. for home use.

So far, the total complaint cost from COVID-19 scams has been around $20 million with an average loss of $545 per complaint, according to the FTC. The top states with more than 1,000 of these fraudulent activities reported are: California, New York, Texas, and Florida. The age category of 30-39 years has had the highest number of cases reported.

As the FTC investigates these complaints, it has begun cracking down on fraudulent activities. For example, the FTC recently charged Ponte Investments, LLC for business fraud. Ponte Investments, LLC is a financial services company, based in Rhode Island, that was trying to defraud small businesses by claiming that it was an approved lender under the new U.S. Small Business Administration’s Paycheck Protection Program (PPP). PPP is a loan program of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act).

Selling COVID-19 cures, tests, or treatments online is also another major activity that the FTC has also had to deal with. For example, on March 9, 2020, the FTC reported that it issued “warning” letters to seven companies claiming cures and treatment for COVID-19. These seven companies were: Vital Silver, Quinessence Aromatherapy, N-ergetics, GuruNanda, Vivify Holistic Clinic, Herbal Amy, and The Jim Bakker Show.

According to the FTC, there is no known cure or treatment for COVID-19 that has been approved for consumer use.

U.S. states and local jurisdictions have also been on the lookout for these COVID-19 scams. Consumers or businesses that feel that they been taken advantaged of or scammed should contact their local District Attorney office or their state office of Consumer Affairs or Consumer Protection. Some states, like Nevada, even have a special task force or group that helps minorities deal with consumer scams.

Consumers should take every precaution possible and avoid answering random calls or text messages. Even if unsolicited email messages seem to be from a legitimate source, consumers should access the webpage of a government office and do not reply to email messages directly.

Small businesses seeking aid from the Coronavirus crisis could go directly to the web resources found on the website of the U.S. Small Business Administration.